Are you aware that there is a way to receive free money from the government? It’s called the Employee Retention Credit (ERC), and it offers a fantastic opportunity for businesses to obtain financial assistance. By understanding the process and requirements, you can potentially benefit from this program and secure extra funds to support your company. In this article, we will explore how you can take advantage of the ERC and access this enticing source of government-funded support. So, let’s dive in and discover how you can get your hands on some extra cash for your business.

Understanding the Employee Retention Credit (ERC)

What is the Employee Retention Credit (ERC)?

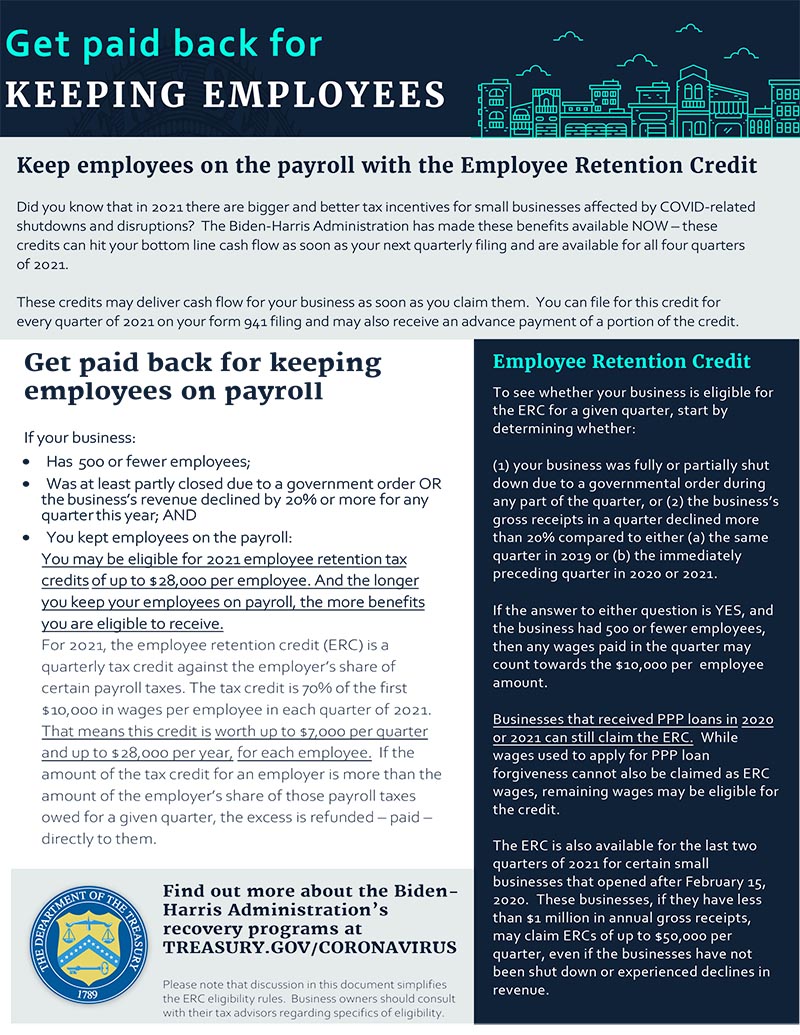

The Employee Retention Credit (ERC) is a valuable incentive introduced by the government to support employers who have retained their employees during the COVID-19 pandemic. This credit is a form of financial assistance that helps businesses offset some of the costs associated with maintaining their workforce. It is designed to encourage employers to keep their employees on payroll and continue operating their business, even during challenging times.

Who is eligible for the ERC?

To be eligible for the ERC, certain criteria must be met. Qualifying employers include those who have experienced a significant decline in revenue due to the pandemic or whose operations were fully or partially suspended by a governmental order. Eligible employees are individuals who are employed by the qualifying employer and have been retained during the eligible time period. Furthermore, there are specific revenue decline requirements that must be met to determine eligibility for the credit.

How does the ERC work?

The ERC works by providing eligible employers with a refundable payroll tax credit. This means that the credit can be used to offset certain payroll taxes owed by the employer, and any excess credit can be refunded to the employer. The credit is equal to a percentage of qualifying wages paid to eligible employees during a specific period of time. By claiming the ERC, businesses can reduce their overall tax liability and potentially receive a financial boost during these challenging times.

What are the key benefits of the ERC?

The Employee Retention Credit offers several benefits to qualifying employers. Firstly, it provides a direct financial incentive to retain employees and continue their operations. This can alleviate some of the financial burden associated with retaining a workforce during times of reduced revenue or operational restrictions. Moreover, the credit is refundable, meaning that even if the credit exceeds the employer’s total liability for payroll taxes, they can still receive the excess as a refund. This can provide a helpful cash infusion for businesses that may be struggling financially. Overall, the ERC serves as a valuable tool for businesses to not only survive the economic impact of the pandemic but also to thrive and recover.

Determining Eligibility for the ERC

Qualifying employers

To determine eligibility for the ERC, it is important to understand the criteria that make an employer eligible. Firstly, qualifying employers must have experienced a significant decline in gross receipts. This means that their gross receipts must be less than 50% of what they were during the same calendar quarter in the previous year. Alternatively, if they were not in existence during the previous year, they can compare their gross receipts to an appropriate quarter in 2019. Additionally, employers whose operations were fully or partially suspended by a governmental order also qualify.

Eligible employees

Eligible employees are individuals who are employed by a qualifying employer and have been retained during the eligible time period. This includes full-time, part-time, and seasonal employees. However, it is important to note that certain family members of the business owners and highly-compensated employees are excluded from eligibility. It is crucial for employers to accurately assess and identify their eligible employees to ensure they claim the credit correctly.

Revenue decline requirements

The ERC imposes specific revenue decline requirements that must be met to determine eligibility. Employers can compare their current calendar quarter’s gross receipts to the same quarter in the previous year. Alternatively, they can compare their gross receipts to the immediately preceding quarter to determine if they satisfy the revenue decline criteria. If their gross receipts for a particular quarter meet the designated thresholds, they are considered eligible for the ERC for that quarter. It is important for qualifying employers to carefully track and document their revenue decline to support their claim for the credit.

Calculating the Employee Retention Credit

Maximum credit amount

The maximum credit amount an employer can claim under the ERC is 70% of qualified wages paid to eligible employees. Initially, the credit was applicable only to the first $10,000 of qualified wages paid per employee in 2020. However, with subsequent legislation and changes, the maximum credit amount was increased to $10,000 per employee per quarter in 2021. This increase ensures that businesses can claim a higher credit amount for each eligible employee, thereby further benefiting their financial position.

Wages eligible for the credit

Not all wages paid to employees qualify for the ERC. To calculate the credit accurately, it is important to identify which wages are eligible. For businesses with more than 100 employees, only wages paid to employees who are not working during the eligible time period due to pandemic-related reasons qualify. However, for businesses with 100 or fewer employees, all wages paid during the eligible time period, regardless of whether the employees are working or not, can qualify for the credit. It is essential to carefully review and categorize the wages to ensure only the eligible ones are included in the calculations.

Calculating the credit for qualifying wages

Calculating the ERC for qualifying wages involves determining the applicable time period, the number of eligible employees, and the percentage of the credit. The credit percentage for 2020 is 50% of qualified wages, while for 2021, it has been increased to 70%. Multiply the qualifying wages paid during the specific time period by the applicable credit percentage to calculate the credit amount. It is important to ensure accurate calculations and retain supporting documentation to substantiate the claim for the credit.

Claiming the Employee Retention Credit

How to claim the ERC

To claim the ERC, it is necessary to report the credit on the employer’s federal employment tax return, typically Form 941. The credit is claimed by reducing the employer’s share of Social Security taxes on the employment tax return. If the credit exceeds the employer’s total liability for Social Security taxes, the excess can be claimed as a refund. Accurate reporting and careful documentation are essential to successfully claim the ERC and ensure compliance with the IRS requirements.

Filing requirements

The filing requirements for claiming the ERC differ depending on the size of the eligible employer. Employers with more than 100 employees must use Form 941 to report the credit on a quarterly basis. On the other hand, employers with 100 or fewer employees can either report the credit on Form 941 or request an advance payment of the credit by using Form 7200. It is crucial for employers to familiarize themselves with the specific filing requirements and follow them accordingly to claim the credit effectively.

Documenting eligible wages

Documenting eligible wages is a critical step in claiming the ERC. Employers must maintain accurate records, including documentation of wages paid to eligible employees and the periods during which those wages were paid. It is advisable to retain records such as payroll reports, timecards, and any other relevant documentation that supports the wages claimed for the credit. Additionally, it is important to document the revenue decline to demonstrate eligibility for the credit. Thorough and organized record-keeping allows employers to confidently claim the credit and provide necessary documentation in case of an audit.

Interaction with other COVID-19 Relief Programs

Comparison with the Paycheck Protection Program (PPP)

The Employee Retention Credit should not be confused with the Paycheck Protection Program (PPP). While both programs provide financial assistance to businesses impacted by the pandemic, they serve different purposes. The ERC is a payroll tax credit, while the PPP is a forgivable loan program. The main distinction is that the ERC focuses on keeping employees on payroll, whereas the PPP aims to help businesses cover payroll expenses and other eligible expenses. Businesses can avail themselves of both programs, as long as they do not double-dip and use the same wages for both the ERC and the forgiveness of PPP loans.

Effect on other tax credits

The ERC may affect other tax credits available to employers. If an employer claims the ERC for certain wages, those wages may no longer qualify for certain other tax credits, such as the Work Opportunity Tax Credit (WOTC) or the Research and Development (R&D) Tax Credit. Employers should consult with tax professionals to understand the implications of claiming the ERC on other tax credits and optimize their overall tax strategy.

Coordination with other government grants

The ERC can be coordinated with other government grants and assistance programs. However, it is important to note that the ERC cannot be claimed on wages that have been subsidized by certain COVID-19 relief programs, such as the Families First Coronavirus Response Act (FFCRA) or the Work Opportunity Tax Credit (WOTC). Employers must carefully evaluate the interactions and restrictions of the ERC with other government grants to maximize their benefits without running afoul of any regulations or requirements.

Tips for Maximizing the Employee Retention Credit

Reviewing eligibility criteria regularly

To maximize the benefits of the ERC, it is crucial for employers to review and assess their eligibility criteria regularly. The eligibility criteria for the ERC have evolved over time with legislative changes and different time periods. By staying up to date on the changes and thoroughly understanding the requirements, employers can ensure they claim the credit correctly and take full advantage of the available benefits.

Keeping detailed records

Keeping detailed records is essential for properly claiming and substantiating the ERC. Accurate records of eligible wages, supporting documentation, and calculations must be maintained to provide evidence of eligibility and credit amounts claimed. Employers should also retain documentation of revenue decline to demonstrate their qualification for the credit. By implementing proper record-keeping practices, employers can minimize the risk of errors, support their claims, and be well-prepared in the event of an audit.

Consulting with tax professionals

Given the complexity of the ERC and the potential impact on other tax credits and relief programs, it is highly recommended for employers to consult with tax professionals. Tax professionals can provide valuable guidance on eligibility requirements, calculation methods, and filing procedures. They can also help businesses optimize their overall tax strategy, ensuring they make the most of the available credits and financial assistance programs. Consulting with tax professionals can provide peace of mind and help employers navigate the complexities of the ERC effectively.

Common Mistakes to Avoid with the Employee Retention Credit

Inaccurate calculations

One common mistake to avoid when claiming the ERC is inaccurate calculations. Due to the complexity of the credit and the various factors involved, it is easy to make errors in determining the credit amount for qualifying wages. Accuracy is crucial when calculating the credit to ensure compliance with the IRS requirements and avoid potential penalties or audits. Employers should double-check their calculations and consider seeking professional assistance to minimize the risk of inaccuracies.

Incorrectly claiming ineligible wages

Another mistake to avoid is incorrectly claiming ineligible wages. Not all wages paid to employees qualify for the ERC, depending on the size of the employer and the specific circumstances. It is important to carefully review the IRS guidelines and accurately identify which wages are eligible. Claiming ineligible wages can result in a reduced credit or even penalties for non-compliance. Thoroughly reviewing and understanding the eligibility criteria can help employers avoid this common mistake.

Missing filing deadlines

Missing filing deadlines is another error to avoid when claiming the ERC. Filing requirements and deadlines differ based on the size of the employer and the forms used. Employers must ensure they are aware of the specific deadlines and meet them accordingly. Failing to file on time can result in the loss of the credit or additional penalties. Staying organized and keeping track of deadlines can help employers meet their obligations and avoid unnecessary complications.

Recent Updates and Changes to the Employee Retention Credit

Legislative changes and extensions

The ERC has undergone several legislative changes and extensions since its introduction. Initially available for wages paid between March 13, 2020, and December 31, 2020, the credit was extended through June 30, 2021, with changes to the eligibility criteria and credit percentage. As of July 1, 2021, the credit has been further extended through December 31, 2021. It is important for employers to stay informed of the latest legislative changes and adhere to the updated requirements to maximize the benefits of the credit.

Guidance from the IRS

The IRS has provided guidance on various aspects of the ERC to help employers understand the requirements and claim the credit correctly. The guidance addresses eligibility criteria, calculation methods, documentation requirements, and filing procedures. Employers should regularly review the guidance issued by the IRS and ensure they are following the most up-to-date instructions. Consulting the IRS publications and seeking professional advice can provide clarity and help employers navigate the intricacies of the ERC.

Key dates and deadlines

Key dates and deadlines associated with the ERC are subject to change based on legislative updates and extensions. Generally, the filing deadline for Form 941, the federal employment tax return, is the last day of the calendar month following the end of the quarter. However, employers should closely monitor any changes to these deadlines and ensure they file their paperwork accordingly. Being aware of the key dates and deadlines allows employers to plan and fulfill their obligations in a timely manner.

Future Prospects of the Employee Retention Credit

Ongoing availability of the credit

The future availability of the ERC beyond its current extension depends on the government’s response to the ongoing pandemic and economic recovery. While the credit has proven to be an effective tool in supporting businesses during challenging times, its continuation will likely be subject to assessment and evaluation. Employers should closely monitor updates from the government and policymakers to stay informed of any changes regarding the availability and conditions of the ERC.

Possible expansions or limitations

There is a possibility of future expansions or limitations to the ERC. As the economic landscape evolves, policymakers may introduce changes to further enhance the credit or align it with new priorities. For example, expansion of the credit to cover additional expenses or industries may be considered. Conversely, limitations may be imposed if the government determines that modifications are necessary to ensure targeted assistance. Employers should stay abreast of legislative developments to anticipate potential expansions or limitations to the ERC.

Impact on businesses and employees

The Employee Retention Credit has had a significant impact on businesses and employees affected by the pandemic. By providing financial assistance to retain employees, the credit has played a vital role in supporting businesses’ financial stability and ensuring continued employment opportunities. The additional funds from the credit have helped businesses navigate the challenges of reduced revenue and operational disruptions. For employees, the ERC has provided some assurance of job security during uncertain times. The credit’s future prospects will continue to influence the stability and well-being of businesses and employees alike.

Conclusion

The Employee Retention Credit is a valuable resource that offers financial assistance to businesses during the COVID-19 pandemic. By understanding and meeting the eligibility criteria, businesses can claim the credit and receive financial support to help retain their employees. The ERC provides benefits such as reduced tax liability and potential refunds, which can help alleviate the financial burden on businesses and contribute to their overall recovery and resilience. Employers are encouraged to explore their eligibility for the ERC, consult with tax professionals, and take advantage of this opportunity to secure financial assistance from the government. By doing so, businesses can maximize their chances of survival and position themselves for future success.