If you’re an agent looking for lucrative opportunities, you’ll definitely want to explore the potential of the Employee Retention Credit. This often-overlooked tax credit can be a game-changer for both small businesses and the agents who assist them. By understanding how to leverage the ERC and effectively guide your clients through the application process, you can not only provide valuable assistance but also generate significant income for yourself. In this article, we’ll explore the key steps you need to take to make money with the Employee Retention Credit as an agent, opening up a whole new avenue of financial success.

Understanding the Employee Retention Credit (ERC)

What is the Employee Retention Credit?

The Employee Retention Credit (ERC) is a valuable tax incentive program introduced by the IRS to help businesses retain their employees during challenging times. It is designed to provide financial relief to eligible employers by allowing them to claim a credit against their payroll taxes.

Who is eligible for the Employee Retention Credit?

Eligibility for the ERC depends on several criteria. It is available to businesses that have experienced a significant decline in gross receipts or have been subject to full or partial suspension of operations due to COVID-19. It applies to both for-profit and nonprofit organizations, with certain exceptions.

How does the Employee Retention Credit work?

The ERC works by allowing eligible employers to claim a credit of up to 70% of qualified wages paid to employees. The credit is applied against the employer’s share of Social Security taxes and any excess can be refundable. The credit amount varies depending on the number of employees and the wages paid during the defined time period.

Benefits of the Employee Retention Credit

The Employee Retention Credit offers several benefits to both employers and employees. For employers, it provides a significant financial incentive to retain their workforce, reduce layoffs, and maintain business operations. It helps alleviate financial burdens and allows businesses to invest in other areas of growth and stability. For employees, the credit ensures job security and allows them to continue receiving regular pay and benefits during challenging times. Overall, the ERC is a win-win solution that benefits both businesses and employees.

Role of an Agent in Maximizing the Employee Retention Credit

What is an agent in the context of the Employee Retention Credit?

An agent, in the context of the Employee Retention Credit, is a professional who specializes in navigating the complexities of the program on behalf of businesses. Agents are well-versed in the regulations and guidelines surrounding the ERC and are equipped with the knowledge and expertise to maximize the credit benefits for their clients.

Why should businesses work with agents?

Businesses should consider working with agents for various reasons. First and foremost, agents have a deep understanding of the ERC and can help businesses determine their eligibility and ensure compliance with the program requirements. Agents can also help businesses navigate the intricate application and filing processes, saving them time and effort. Additionally, agents can provide ongoing support, staying updated with any legislative and regulatory changes related to the ERC, and assisting with audits and appeals if necessary.

Responsibilities of an agent

The primary responsibility of an agent is to help businesses optimize their eligibility for the ERC and maximize the credit they can claim. This involves assessing the eligibility criteria, calculating the credit amount based on the employees’ wages, and guiding businesses on the necessary documentation required for claiming the credit. Agents also play a crucial role in identifying and addressing any potential issues or challenges that may arise during the process, ensuring a smooth and successful experience for their clients.

Potential income opportunities for agents

Becoming an agent for the Employee Retention Credit presents exciting income opportunities. Agents can charge a fee for their services, which can be based on an hourly rate or a percentage of the credit amount claimed. As more businesses seek assistance with navigating the ERC, agents can establish a steady clientele and build a reputation as reliable and knowledgeable professionals in the field. Additionally, agents can explore additional revenue streams by offering ancillary services like payroll management and assistance with other government tax credits.

This image is property of www.teamais.net.

Becoming an Agent for the Employee Retention Credit

Understanding the requirements

To become an agent for the Employee Retention Credit, it is crucial to have a solid understanding of the program’s requirements and guidelines. This includes familiarizing oneself with the eligibility criteria, wage calculations, documentation requirements, and any updates or changes to the program. A thorough understanding of IRS guidance and tax regulations is also essential.

Registering as an agent

Registering as an agent for the Employee Retention Credit involves obtaining the necessary credentials and certifications. This may include becoming an enrolled agent with the IRS or obtaining other professional certifications in tax and accounting. Registering with professional organizations and associations related to tax incentives and credits can also enhance credibility and provide access to valuable resources and networking opportunities.

Building expertise and knowledge

Building expertise and knowledge in the field of the Employee Retention Credit is essential to becoming a successful agent. This involves engaging in continuous education and training programs to stay updated with the latest legislative and regulatory developments. It may also involve attending seminars, workshops, and conferences specifically focused on the ERC. Additionally, agents should invest time and effort in conducting thorough research, reading industry publications, and leveraging digital platforms for knowledge sharing and networking.

Marketing your services as an agent

Marketing plays a crucial role in attracting clients and establishing oneself as a trusted agent for the Employee Retention Credit. Agents can market their services through various channels, such as creating a professional website, utilizing social media platforms, and leveraging professional networks. Providing informative content, such as blog articles and webinars, can showcase expertise and instill confidence in potential clients. Networking with other professionals in the tax and accounting industry can also lead to valuable referrals and collaborations.

Offering Consultation and Advisory Services

Assessing eligibility and credit calculation

As an agent, a key responsibility is to assess a business’s eligibility for the Employee Retention Credit. This involves evaluating if the business meets the criteria for a significant decline in gross receipts or a full or partial suspension of operations. Additionally, agents need to calculate the credit amount based on the wages paid to employees during the eligible time period. By accurately assessing eligibility and conducting precise calculations, agents ensure their clients receive the maximum credit they are entitled to.

Providing guidance on necessary documentation

Navigating the documentation requirements for the Employee Retention Credit can be complex for businesses. Agents play a critical role in providing clear and concise guidance on the necessary documentation, such as payroll records, tax filings, and financial statements. They assist businesses in organizing and preparing the required documentation, ensuring compliance with the program’s guidelines and enhancing the chances of a successful claim.

Identifying and addressing potential issues

While claiming the Employee Retention Credit, businesses may encounter various potential issues or challenges. Agents have the expertise to identify these issues early on and address them effectively. This may involve resolving discrepancies in documentation, addressing questions from the IRS, or providing additional supporting information. By proactively addressing these issues, agents help businesses avoid delays and increase their chances of a successful credit claim.

Developing strategies for maximum credit utilization

Agents go beyond the basics and help businesses develop strategies for maximum credit utilization. They analyze the business’s unique circumstances, such as workforce size, wage structure, and industry-specific factors. Based on this analysis, agents can provide tailored recommendations to optimize the credit benefits. These may include suggestions for adjusting employee wages or exploring other relevant tax incentives. By developing comprehensive strategies, agents ensure their clients make the most of the Employee Retention Credit.

This image is property of www.mdaprograms.com.

Managing the Employee Retention Credit Process

Handling application and filing processes

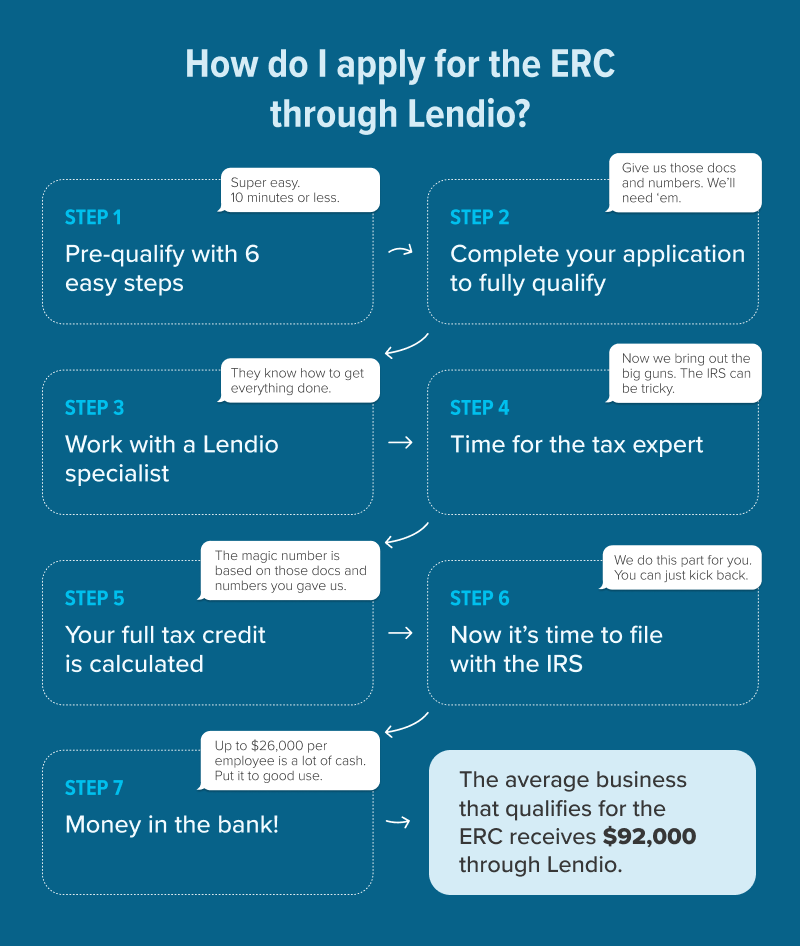

The application and filing processes for the Employee Retention Credit can be time-consuming and intricate. Agents play a crucial role in handling these processes on behalf of their clients. They ensure the accurate completion of all required forms and documentation, including Form 941 and Form 7200. Agents also maintain a thorough understanding of deadlines and submission requirements, ensuring a smooth and timely process.

Monitoring compliance and updates

Once a business has successfully claimed the Employee Retention Credit, agents continue to monitor compliance with the program’s requirements. This includes staying abreast of any legislative or regulatory changes that may impact the credit eligibility or calculation. Agents help businesses navigate these updates, ensuring ongoing compliance and avoiding any penalties or disruptions.

Maintaining records and documentation

Record-keeping is crucial when it comes to the Employee Retention Credit. Agents assist businesses in maintaining accurate and organized records of all relevant documentation, including payroll records, tax filings, and supporting documents. This ensures easy access to information for future reference, audits, and appeals.

Assisting with audits and appeals

In the event of an audit or an appeal related to the Employee Retention Credit, agents provide valuable support and assistance to businesses. They help businesses gather and present the necessary documentation and information requested by the IRS. Agents can also represent their clients during audits and appeals, ensuring a fair and thorough process.

Collaborating with Businesses and Clients

Building relationships with potential clients

Building relationships with potential clients is key to the success of an agent. Agents can actively engage in networking activities, attend industry-specific events, and leverage digital platforms to connect with businesses seeking assistance with the Employee Retention Credit. By building trust and rapport, agents can establish long-term relationships with businesses, ultimately leading to a steady client base.

Conducting educational seminars and workshops

Educational seminars and workshops provide agents with an excellent opportunity to showcase their expertise and educate businesses about the benefits of the Employee Retention Credit. By conducting informative sessions, agents can attract potential clients and position themselves as trusted advisors in the field. These events also serve as platforms for networking and building connections with other professionals and experts.

Tailoring solutions to individual business needs

Each business is unique and may require customized solutions when it comes to the Employee Retention Credit. Agents play a vital role in tailoring their services to meet individual business needs. This involves conducting thorough assessments, consulting with businesses, and understanding their specific challenges and goals. By providing personalized solutions, agents ensure their clients receive the most relevant and beneficial guidance.

Offering ongoing support and communication

Support and communication are essential elements of a successful agent-client relationship. Agents should be readily available to address any questions or concerns that clients may have throughout the Employee Retention Credit process. Providing ongoing support and keeping clients updated on important developments and deadlines fosters trust and confidence in the agent’s services.

This image is property of www.lendio.com.

Exploring Additional Revenue Streams

Developing training programs and materials

Agents can generate additional revenue by developing training programs and materials related to the Employee Retention Credit. These can include online courses, webinars, or workshops that educate businesses and professionals about the intricacies of the credit. By sharing their knowledge in this way, agents can attract a broader audience and establish themselves as thought leaders in the field.

Providing ancillary services like payroll management

Complementing the services related to the Employee Retention Credit, agents can offer ancillary services such as payroll management. Many businesses struggle with the complexities of payroll management, and agents can step in to provide solutions. By offering comprehensive payroll services, including payroll processing, tax withholding calculations, and payroll tax filings, agents can generate additional revenue while addressing a common pain point for businesses.

Offering assistance with other government tax credits

The Employee Retention Credit is just one of several tax credits offered by the government. Agents can expand their services by offering assistance with other tax credits, such as the Research and Development (R&D) Tax Credit or the Work Opportunity Tax Credit (WOTC). By diversifying their offerings, agents can cater to a broader range of businesses and increase their revenue potential.

Expanding services to related financial areas

Agents can consider expanding their services to related financial areas to generate additional revenue. This may include offering assistance with tax planning and strategy, financial forecasting, or general accounting services. Taking a holistic approach to a client’s financial needs allows agents to build long-term relationships and create sustainable revenue streams.

Networking and Partnerships

Joining professional organizations and associations

Joining professional organizations and associations related to tax incentives, credits, or the accounting industry can be highly beneficial for agents. These organizations provide access to valuable resources, networking opportunities, and industry-specific knowledge. Agents can collaborate with other professionals, learn from their expertise, and gain insights into best practices.

Attending industry conferences and events

Attending industry conferences and events is an effective way for agents to network with businesses and professionals. These events often feature educational sessions, workshops, and networking opportunities. Agents can showcase their expertise, connect with potential clients, and stay updated with the latest trends and developments in the industry.

Collaborating with other professionals and experts

Collaboration with other professionals and experts in the tax and accounting industry can broaden an agent’s reach and enhance their service offerings. Agents can form partnerships or strategic alliances with individuals or firms specializing in complementary areas. By leveraging each other’s strengths and expertise, agents and their collaborators can provide comprehensive solutions to businesses and create mutually beneficial relationships.

Utilizing digital platforms for networking

Digital platforms offer agents the ability to expand their network beyond geographical limitations. Agents can use social media platforms, professional networking sites, and online forums to connect with businesses and professionals interested in the Employee Retention Credit. By actively engaging in these platforms, agents can build relationships, share knowledge, and attract potential clients.

This image is property of www.lendio.com.

Staying Updated with Regulations and Changes

Following legislative and regulatory updates

The landscape of tax incentives and credits, including the Employee Retention Credit, is subject to legislative and regulatory changes. Staying updated with these changes is imperative for agents to provide accurate and reliable guidance to their clients. Agents should regularly monitor legislative updates, IRS guidance, and other relevant sources to ensure they are aware of any changes that may impact the eligibility, calculation, or claiming process of the credit.

Engaging in continuous education and training

Continuous education and training are essential for agents to stay at the forefront of the Employee Retention Credit field. Agents can participate in professional development programs, attend webinars, and enroll in relevant courses to enhance their knowledge and expertise. This continuous learning ensures that agents are equipped with the latest information and best practices, allowing them to provide the highest level of service to their clients.

Subscribing to industry newsletters and publications

Subscribing to industry newsletters and publications is an effective way for agents to stay informed about recent developments and trends related to the Employee Retention Credit. Industry-specific publications, newsletters, and blogs often provide valuable insights, legislative updates, and practical tips that agents can leverage to enhance their services and stay ahead of the curve.

Understanding the impact of IRS guidance

The IRS provides regular guidance on the Employee Retention Credit through various means, such as notices, revenue rulings, and frequently asked questions (FAQs). Agents should closely review and understand this guidance to ensure compliance and accuracy in their services. They should be aware of any changes in interpretations or clarifications provided by the IRS, as these can significantly impact the eligibility and claiming process.

Ensuring Ethical Practices and Compliance

Maintaining confidentiality and data security

Agents have access to sensitive and confidential information related to their clients’ businesses. It is essential for agents to prioritize confidentiality and data security to maintain trust and comply with ethical standards. Agents should implement robust data protection measures, including secure storage systems and secure communication channels. They should also maintain strict confidentiality when it comes to client information and only disclose information as required by law or with the client’s consent.

Adhering to professional standards and codes of conduct

Agents should adhere to professional standards and codes of conduct. This includes conducting themselves with integrity, honesty, and professionalism in all aspects of their work. Agents should maintain high ethical standards and avoid engaging in any activities that may compromise their professionalism or reputation.

Avoiding conflicts of interest

Agents must avoid conflicts of interest that may compromise their objectivity and impartiality. They should disclose any potential conflicts to their clients transparently and take appropriate steps to mitigate them. Agents should always act in the best interest of their clients and avoid any actions that may have personal gain at the expense of their clients’ interests.

Providing transparent and accurate information

Agents should provide their clients with transparent and accurate information at all times. This includes being upfront about the limitations and risks associated with the Employee Retention Credit and clearly communicating the potential outcomes and benefits. Agents should ensure that their clients have a clear understanding of their services, fees, and any obligations or responsibilities the clients may have throughout the process.

In conclusion, understanding the Employee Retention Credit and becoming an agent for this tax incentive program can provide lucrative opportunities for professionals. By offering consultation and advisory services, managing the credit process, collaborating with clients, exploring additional revenue streams, networking, staying updated with regulations, and adhering to ethical practices, agents can establish themselves as trusted advisors and maximize their potential in the field of the Employee Retention Credit.